vermont department of taxes homestead declaration

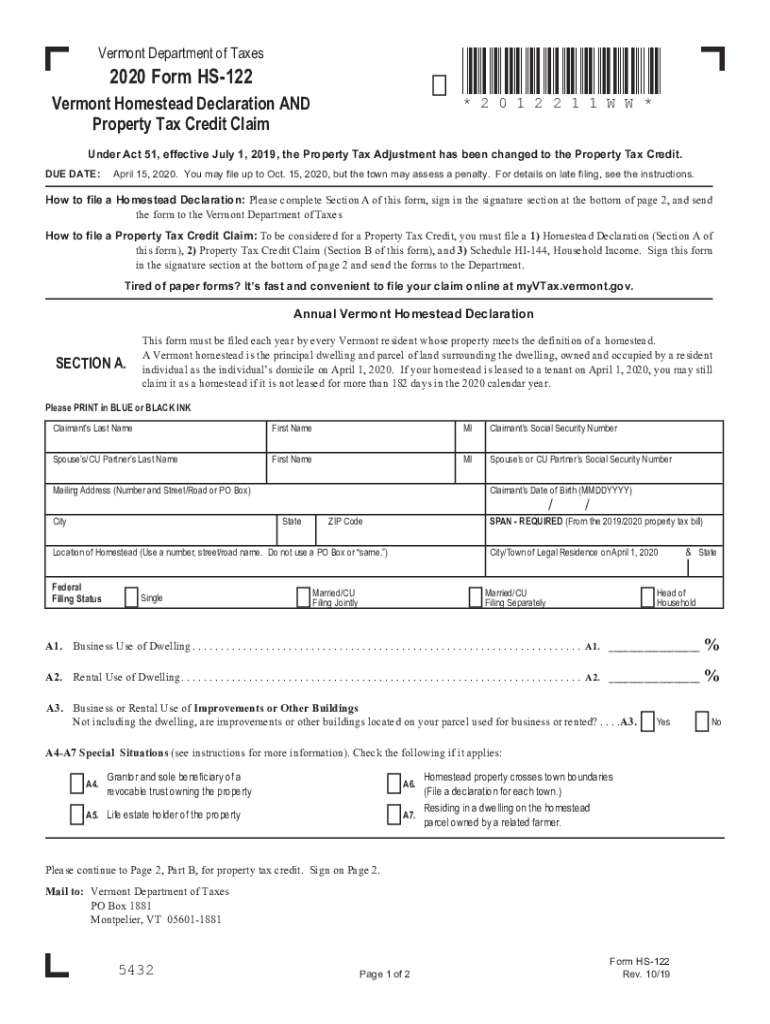

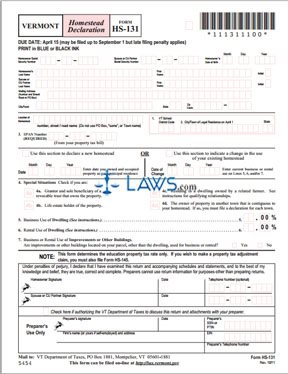

Homestead Declaration Each person who owns property and lives on that property must declare homestead this year by April 18th. A Vermont homestead is the principal dwelling and parcel of land surrounding the dwelling owned by a resident individual as of April 1st and occupied as a persons domicile.

Vermont Homestead Form Hs 122 Fill Out Sign Online Dochub

802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BJLRDZPNXVPSDCSXP6ZA3764MM.jpg)

. Go digital and save time with signNow the best. Mon 01242022 - 1200. Vermont Business Magazine The Vermont Department of Taxes wants to remind Vermonters of the upcoming May 17 2021 due date for federal and Vermont personal income taxesEarlier.

Domicile Statement Property Tax Homestead Declaration Domicile Statement Vermont Department of Taxes Phone. Information on upcoming tax filing deadlines and. First Installmentof the 2022-2023 property taxes due 400 PM Tuesday November 15 2022 This property tax bill includes two installment coupons attached to the bottom and also includes.

Department of Taxes. Tax examiners in this division can. Homestead Declaration and Property Tax Adjustment Filing Vermontgov Freedom and Unity Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and.

We last updated the Homestead Declaration AND Property Tax Adjustment Claim in March 2022 so this is the latest version of Form HS-122 HI-144 fully updated for tax year 2021. BUYING AND SELLING PROPERTY Buying on or before. Taxpayers having trouble filing Homestead Declarations and Property Tax Credit Claims may call 802 828-2865 for help.

Use the housesite value found on the 20212022 property tax bill of the property you own and occupy on April 1 2022. Printing and scanning is no longer the best way to manage documents. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim.

Handy tips for filling out Vermont homestead declaration online. 802 828-2865 133 State Street Montpelier VT 05633-1401 For. If you do not file by this date then you will receive a penalty.

April 18 Vermont Personal Income Tax and Homestead Declaration Due Date Press Release Wed 04062022 - 1200 The Vermont Department of Taxes reminds Vermont. Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here.

Form Hs 122 Hi 144 Fillable Homestead Declaration Property Tax Adjustment Claim

Free Form Hs 131 Homestead Declaration Free Legal Forms Laws Com

Declaring Your Vermont Homestead Unusual Situations Youtube

Reminder U S And Vermont Income Taxes Must Be Filed By May 17

Homestead Laws Taxes And Exemptions And The Homestead Act

Vt State Tax Form Information Town Of Cave

Vermont State Tax Software Preparation And E File On Freetaxusa

Form Hs 122 Hi 144 Fillable Homestead Declaration And Property Tax Adjustment Claim

How To Register For A Sales Tax Permit In Vermont Taxvalet

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Tax Information Town Of Craftsbury

Form Hs 122 Hi 144 Fillable Homestead Declaration Property Tax Adjustment Claim

Vermont Form Hs 122 Hi 144 Homestead Declaration And Property Tax Adjustment Claim 2021 Vermont Taxformfinder

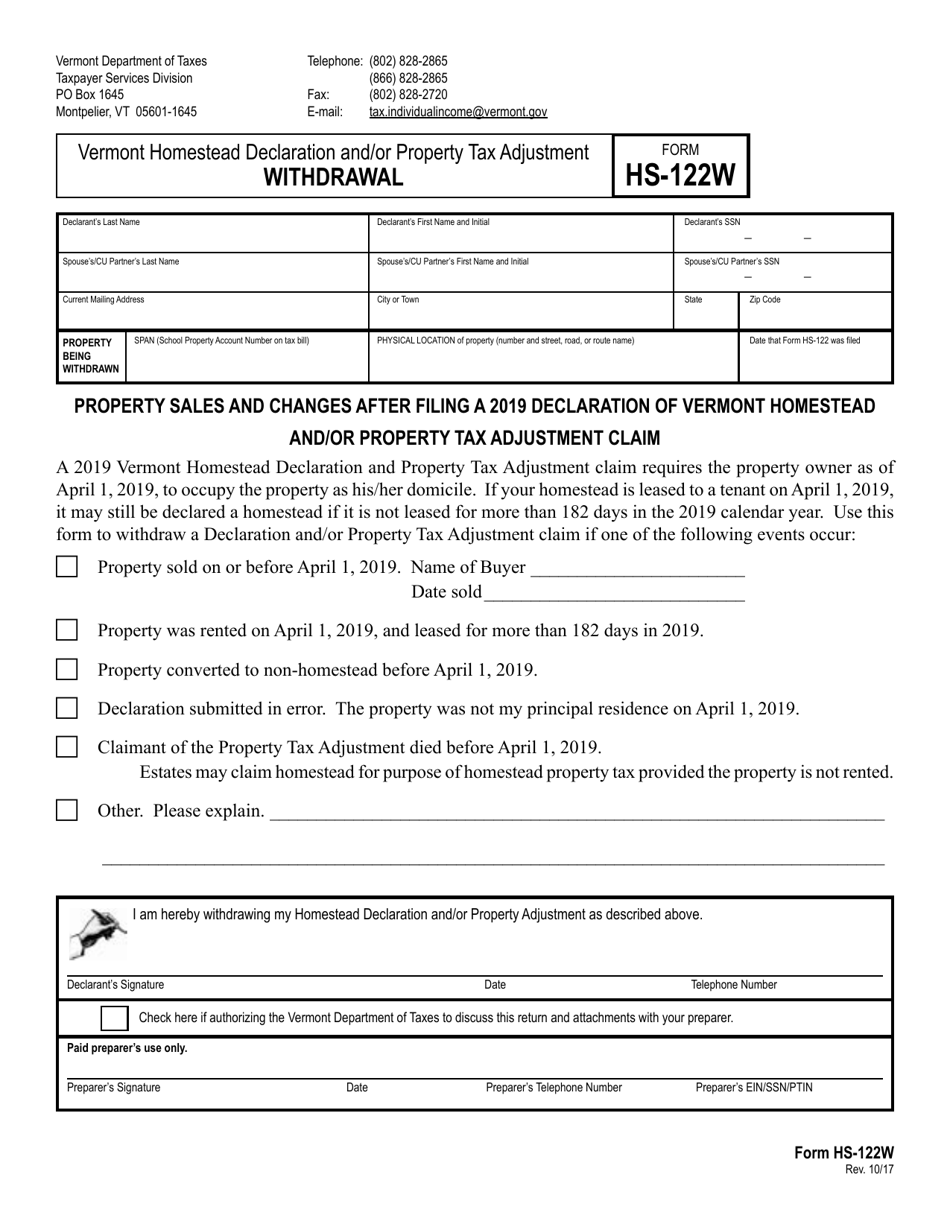

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Department Of Taxes Agency Of Administration Vermont Department Of Taxes Property Transfer Tax Return Online Service Proposal Created By The Vermont Department Ppt Download

Renter Credit Webinar For Landlords Housing Trusts And Mobile Home Park Operators Youtube